We

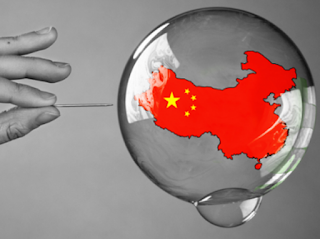

all have been reading reports off lately about the Chinese economic slowdown.

We might have wondered what it is and why is it of some grave importance in our

context. Chinese economic slowdown refers to the reduction in the rate of the growth of the Chinese economy than

what was predicted by the economists worldwide. The Chinese GDP growth was not

as fast was expected at 8% but was a

slower progress of 7%.

Due to this there has been a major cut-down on the working class people in China with a large number of layoffs and increasing unemployment. Now, this is a situation for both the global economy as well as our economy. The Chinese economy is the second largest economy in the world and its share in the global GDP is extremely significant. Moreover, it has been seen that the Chinese economy is mainly export based. Due to this, there are some facets to the impacts the slowdown has to the global economy in general.

Click here to read: Government announcement on OROP

Also read: All you need to know about Interview round of SSB

The Global Impact:

Firstly, it has been studied that

the contribution of China to the global economy is so significant that the

slowdown of even 2 percentage per year in the Chinese GDP will mean a reduction of 0.5% in the global GDP.

Many economists hence term China as the “engine

that drives the global economy”. But saying that the Chinese economy is the

one which drives the global economy is slightly flawed. This is because a

driving economy is one due to which the economy of other nations prospers. An

economy that is rapidly growing may be growing at the expense of other

economies too.

The

best example is the fact that although the Indian textile production was

extremely high and of great quality in the global scenario, but Britain was the

world leader in textile production due to the better benefits given to the

British textile producers and the intentional slowing down of the Indian

textile market. Although the effect of Chinese economy on the world is not the

same as that of Britain on Indian textile industry, but the fact that Chinese

economy has thrived on the expense of reduction in the magnitude of export from

other economies which were producing the same export commodities as China got

hit by the booming of the Chinese economy.

Some

other implications are the Latin

American countries getting hit really bad. This is because just like China,

their economies are extremely dependent on oil exports. And a slowdown in the

Chinese economy would directly mean a global reduction in oil and mineral

prices, which hits their markets. Even the economies of nations which are

dependent on exporting goods to China get affected badly as they cut down on the imports owing to the

slowdown. This can be seen clearly in the scenario of this slowdown on Indian

economy.

Impact on India:

The growth of Indian economy is extremely based

on exports to China. Since China has a really big secondary sector

industries with heavy demands for engineering equipment. These engineering

parts were usually exported by us. Now, since the major imports from China are

electronics and cheap hardware which are still increasing in demand, there

arises a situation in our economy wherein the Chinese imports to India have

been on rapid increase but the exports have declined due to the slowdown. Due

to this, India owes approximately 4.5

billion US dollars in deficit, which has a chance of increasing.

Click here for : Ten tips for cracking SSB successfully

Also read: Secret of Officer like qualities at SSB

But, not

all economists look at this situation in a grim perspective. The silver lining

in the cloud is the fact that a large number of industries in India and their

exports got extremely hampered due to the cut-throat competitive pricing and

mass production of Chinese counterpart goods. So, this provides an opportunity

for us to become global market leaders

in export of many commodities and in the rise of industries like hardware,

sports equipment and so on.

Hence,

we can see that although the Chinese economic slowdown has some effects on the

global economy, but there is a bright side as the global economy can still be

buffered from this crisis. Frankly, calling it a crisis also may be an

understatement since the Chinese economy is not on the verge of collapse, which

will hit the global economy but it is in a phase of long, gruelling periods of

slow economic growth, which may not be a rosy scenario for China, but does not

affect the global economy in the long run.

About the Author :

Albin Jose did his schooling from Noida and completed his B.Tech from IIT Madras and currently working with an education based-firm in Mumbai. In free time, he like to read and go on treks in and around Mumbai. Through his articles he want to spread awareness among the aspirants.

|

No comments:

Post a Comment