Let’s

start on with a throwback about GREECE! A quick questionnaire – What comes to

your mind first and foremost when you hear / read about Greece? Majority would

be saying its history its mythology, gods like Zeus, Poseidon etc. the

youngsters will link Greece to games like God Of War, Hercules, Wrath Of Gods

and so on.

I must say if this is your answer then you are perfectly correct

and on the right track. Let me add one more point Greece is the hub of tourism

industry because of its mythological locations and temples and even was the

symbol of power. So coming on to the part which even you might be wondering

what actually went wrong because of which such a drastic crisis struck in this

huge country?

Here

is what happened – Before 1990’s there was no

formation of Eurozone and each country had its own currency and an

independent market so if there is a single party involved always it can’t be a

man army hence the euro was introduced in Europe in Jan 1999.

Now

another question will strike your mind WHY

EURO?

The

euro was created because a single currency offers many advantages and benefits

over the previous situation where each Member State had its own currency.

Click here to read: Success factor for performing well in AFCAT Exam.

Also read: Ten tips to perform best in AFCAT Exam.

Like:-

Not

only are fluctuation risks and exchange costs eliminated and the single market

strengthened, but the euro also means closer co-operation among Member States

for a stable currency and economy to the benefit of us all. This shall but

naturally increase the GDP of the countries and many more long term benefits.

But

as we know there is always a risk in driving a car compared to that the market

of countries are ocean so you can imagine the risks associated with it whether

it’s a part of a union or an independent nation.

Few points of Greece being a part of

Eurozone:-

·

It had the fastest growing economy from 2000-2007.

·

Greece is, as a percentage of GDP, the second-biggest defense

spender in NATO, the highest being the United States, according to NATO

statistics.

The reasons which caused the crisis:-

·

GDP growth rates: After 2008, GDP growth rates were lower

than the Greek national statistical agency had predicted to be.

·

Reckless expenditure by government without revising the

taxations i.e. from 2004-09 the expenditures increased by 87% to only 31% hike

in taxes.

·

Huge debt-fallen government and lack of measures to improve

the taxes.

·

Failure in providing exact details and even hiding certain

stats from euro zone for the analyzing there economy.

·

Giving pension to all the citizens after a particular age

which was 97% of their last salary.

Debt

Stats:-

The figure for Greek government debt

at the end of 2009 was also increased from its first November estimate at

€269.3 billion (113% of GDP) to a revised €299.7 billion (130% of GDP).

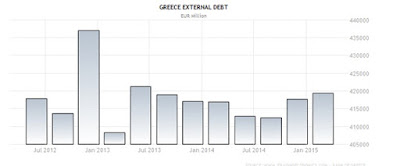

External

Debt in Greece increased to 419411.30 EUR Million in the first quarter of 2015

from 417620.90 EUR Million in the fourth quarter of 2014. External Debt in

Greece averaged 325974.95 EUR Million from 2003 until 2015, reaching an

all-time high of 437025 EUR Million in the fourth quarter of 2012 and a record

low of 142217 EUR Million in the first quarter of 2003. External Debt in Greece

is reported by the Bank of Greece

Click here to read: How to write good WAT in psychology ?

Also read: OROP - One Rank One Pension - All You need to know

This

crisis had a great aftermath which could have had resulted in ‘GREXIT’ i.e.

which means exit of Greece from Eurozone which would have caused economic break

of Euro market in the world and many social and economic effects like –

·

GDP per capita fell from a peak of €22,500 in 2007 to €17,000

in 2014, a 24% decline.

·

Revenues for 2014 were €86 billion (about 48% GDP), while

expenditures were €89.5 billion (about 50% GDP).

·

The unemployment rate has risen considerably, from below 10%

(2005–2009) to around 25% (2014–2015).

·

An estimated 44% of Greeks lived below the poverty line in

2014.

·

Greece defaulted on a $1.7 billion IMF payment on June 29,

2015. Greece had requested a two-year bailout from its lenders for roughly $30

billion, its third in six years, but did not receive it.

Solutions:-

Greece

requested an extension and was even granted but it again failed to repay the

debt but on seeing it’s situation big countries like Germany and France stepped

forward to grant a loan to Greece provided Greece agrees to certain terms and

conditions like:-

·

Revising its taxation pattern.

·

Increment of Taxes.

·

Reduction of salaries.

·

Revising pension law and so on.

This

crisis surely delivers the message to the whole world about do’s and don’ts in

the economy even it teaches the necessity of controlling the government’s

reckless expenditure during lack of funds and eventually justifies that loans

can often land you in a trouble say it be a private loan or loan take from IMF

by a particular nation.

Concluding

with a quick fact Greece had only 350million € left over in its bank during

this crisis the scenario is beyond imagination.

What

if Greece had its own currency and this happened?

Well

since it was an independent market so government could have reduced the value

of its currency as were hiked the prices. Basically the scenario wouldn’t have

had been so serious.

There

is a discussion going in Greece about a new currency ‘drachma’ but they can’t

implement until they clear off their debts.

Hence,

Being a part of Eurozone is a beneficiary if the nations implement and follow

laws else you know what can happen.

Hope you like our efforts. Share it with your friends and follow us here , subscribe for email notification so that you do not miss on any update.Visit our Contact us section in case of queries and to join our facebook group where family of defense aspirants, future officers and selected candidates are having discussion on whats happening.

Hope you like our efforts. Share it with your friends and follow us here , subscribe for email notification so that you do not miss on any update.Visit our Contact us section in case of queries and to join our facebook group where family of defense aspirants, future officers and selected candidates are having discussion on whats happening.

About the Author:

Vinesh Kemchandani is an

Ex- Dipsite who has been a state horse rider of Maharashtra since last 3 years and is doing horse riding for 11 years and wants to become an international level rider. He has achievements in

other sports too in his kitty. He is excellent in studies and has scored good

ranks in many Olympiads at international level. He desires to become an

officer and has cleared his NDA in 2015.

|

No comments:

Post a Comment